Glencoe partners with Father Gorman and Lloydminster to foster growth

By Andrew Seale | Freelance Journalist

At Father Gorman Community School a group of students – grades three to seven – line up, trays in hand to pick from the spread of cut veggies, fruits and leafy greens.

There’s a smorgasbord of healthy eats to fill their bellies and energize their growing minds.

But this isn’t just any salad bar; it’s a prized example of collaboration between Glencoe Developments and the community.

“Glencoe has been one of our long term sponsors – we count on their continued support not just to help run a salad bar, but to share how other community groups can get involved, support for our grant applications, and to keep this program running next year,” says Glenda Kary, Principal at Father Gorman. “By having strong community support, we have other schools showing interest in having a school salad bar.”

The salad bar, which takes place two Thursdays a month, acts as a springboard for teaching kids about nutrition.

“The students love it – they are often surprised by a fruit or veg that they like now that they did not like last year,” she adds. “Or they discover something they never tried at home because it’s not a choice or family members don’t like it.”

Kary points out that the collaboration with Glencoe teaches the young’uns about giving back to the community.

“It demonstrates to students how they can give back when they are older by seeing the sponsors stop in at the school on special days,” she says.

But as Lloydminster Mayor Rob Saunders points out, Glencoe is no stranger to community building.

“Glencoe is involved in many aspects of the community,” says Saunders. “It doesn’t matter if it’s minor hockey or any type of community event, they’re always there to help support and we see them as a highly valued corporate contributor and partner in our city, a key component to our future growth.”

He sees partnerships, like the one at Father Gorman Community School as vital to the sustainable and rapid growth of Lloydminster – especially given its booming young family population.

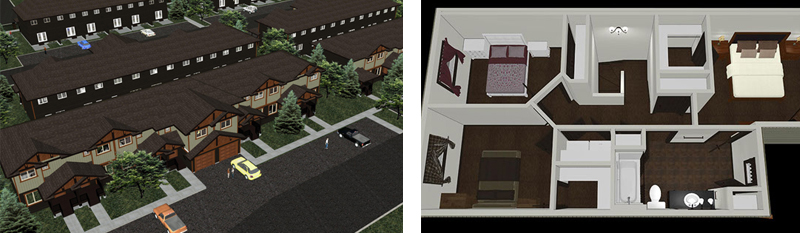

“Glencoe President Ashley McGrath and his team have been front and center in helping to provide new opportunities for new housing initiatives in Lloydminster,” adds Saunders. “They’re very in-tune with what the needs of the people are and that takes extra effort – we appreciate the efforts they take to get to know their customers.”

For more information on the Father Gorman Community School’s Salad Bar Sponsorship Program, contact Alison Fulkerth at (306) 825 4600 or afulkerth@lcsd.ca.

For more information on Glencoe Development Inc. projects in Lloydminster, visit Our Projects page.

About the writer: Andrew Seale (Toronto, ON) has been a reporter and professional writer for nearly a decade. His work has been published in Globe and Mail, Toronto Star, Vancouver Sun and Calgary Herald. Andrew has penned pieces on everything from seahorses and sustainability to innovation in the building sector. He is interested in people and community, which is probably a byproduct of growing up in a small town of 4,000 people in Southwestern Ontario.